The average salary for a landlord in Oklahoma is $73,058 a year. Some landlords see earnings as high as $139,424.

Oklahoma City owners can look forward to this salary with the right investments. You might be a guru at finding sweet deals, but can you handle day-to-day accounting operations?

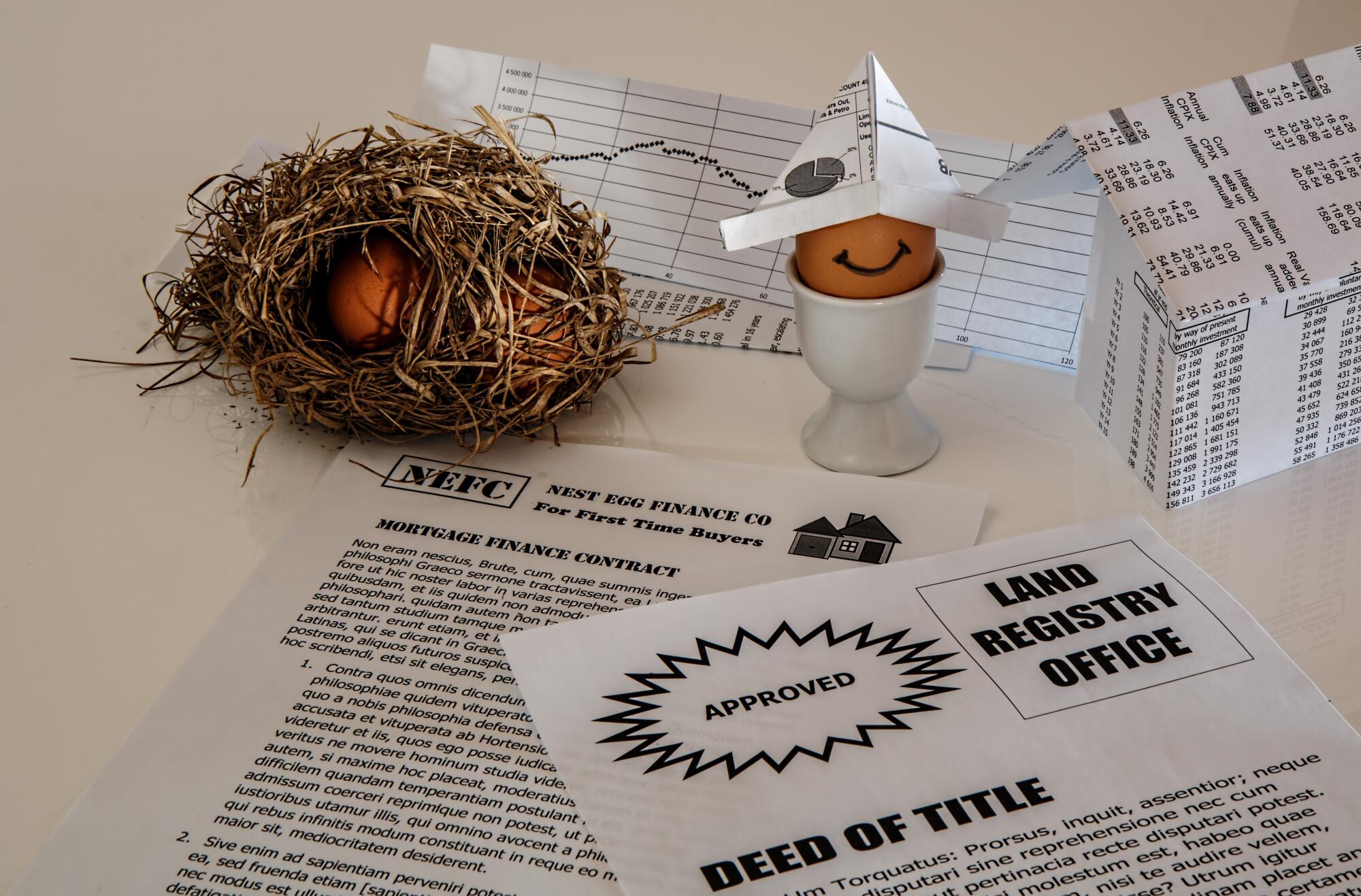

Crunching numbers isn't for everyone. However, if you want to ensure your earnings are accurate, you need to know some things. Understanding owner disbursements is one of them.

Keep reading to learn more about your profits and how you get them.

Defining Owner Disbursements

Owner disbursements are paid out to investors monthly. These payments are the earnings an investor makes from their rental property. Rather than a business expense, it is a percentage of the overall profit.

A property management company will send real estate owner disbursements monthly. Without a property manager, owners will have to handle this themselves. If you don't have accounting experience, this could be tricky.

Owner disbursements are usually detailed in owner statements. Income and expenses are also included in these statements. You'll get a complete view of how your property is performing and what you can do to improve it.

Turn Profits Into Working Capital

An investment property is a gateway to other investments. With the profits you make from one property, you can diversify your real estate portfolio.

Some investors choose to use the profits for personal reasons, while others reinvest their earnings to increase their overall income over time.

You can look for different types of real estate in Oklahoma City or check out other booming neighborhoods in Oklahoma. You can also start investing out of state with the help of a property management company.

You can also turn profits into working capital to put back into the same property. This is great for paying for upgrades and new amenities.

Managing Owner Disbursements

A property investor can manage owner disbursements with an organized system. A property manager can do this if you prefer to be hands-off.

This checklist can help a real estate owner get started:

- Separate personal and business finances

- Track expenses

- Allocate funds for maintenance and repairs

- Keep accurate records

- Understand tax implications

Having a system in place will ensure you get the profits you earn. You'll also avoid missing out on money-saving rental property tax deductions.

When you hire a property management company, they will handle all your accounting records. You'll get reports on income, expenses, and your account ledger.

Work With a Property Manager in Oklahoma City

Owner disbursements are the money you make on a rental property. If you want your records to be accurate, work with a property manager in Oklahoma City.

PMI OKCity Local is a family-owned and operated property management company that helps clients like you. We offer worry-free, peace-of-mind services so that you can enjoy your income without too much work.

For over twenty years, we've offered comprehensive financial reporting to investors. Let our specialized accounting staff keep tabs on your investment.

Fill out our contact form or call us at 405-925-1192 for immediate help.